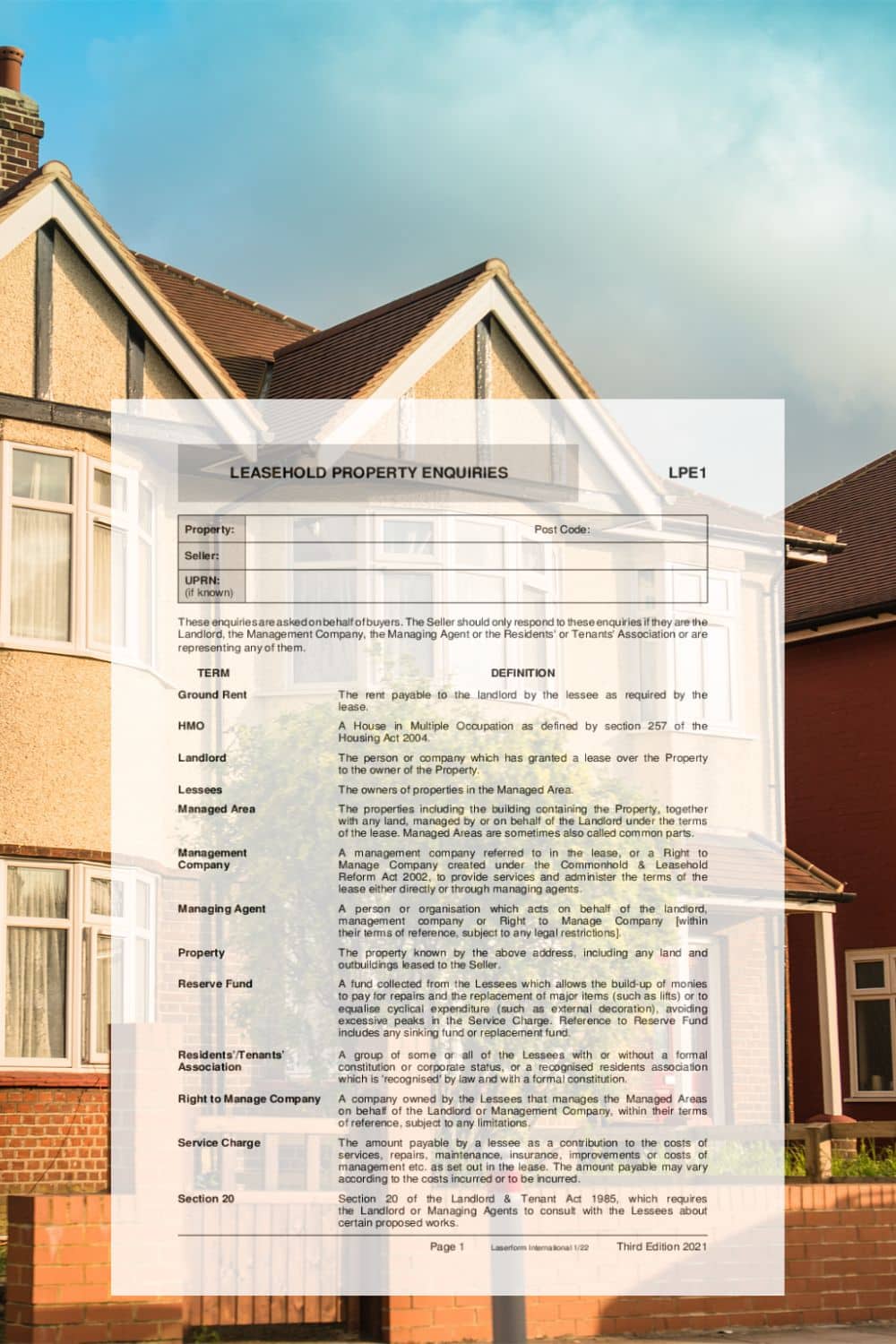

I didn’t know what an LPE1 form was until the sale of my flat was going through. But it is a legally binding document that is essential for the sale of a leasehold property.

It holds important information about the property, service charges, ground rent and the acting management company.

It also helps to establish if there are any issues with the management company or disputes that the prospective buyer needs to know about.

What Is An LPE1 Form?

The LPE1 form (leaseholder property enquiry) is a legally binding document that is used to obtain information relating to the property, including service charges, ground rent, information about the management company, disputes and building insurance. This then becomes part of the leasehold management pack which is sent to the purchasers solicitors. It isn’t a mandatory part of selling a leasehold property, however, it often is legally required from the purchaser and needs to be in place for the sale to go through.

What Sections Are In An LPE1?

There are 8 sections covered in an LPE1 which include;

- Contact details of the landlord, managing agent, management company, residents/tenants association. It also requires identification of whom is in charge of collecting monies such as service charges, ground rent and who deals with the management of the building.

- Transfer and registration – this covers information on the Deed of Covenant.

- Ground rent – this details the annual ground rent charge to the leaseholder and if it has been paid up to date.

- Service charge – this details the service charges, the current annual charges, if there are arrears and any proposed internal works to the property.

- Buildings insurance – includes information regarding building insurance for the property for the current period, if there have been any previous claims and if there are any outstanding issues with the property.

- Disputes and enfranchisement – if there are any ongoing disputes or lease breaches.

- General – this details how many other properties are managed in the same building and if they are all leased on the same terms.

- Required documents – this is the final part which concludes the management pack. This should include proof of service charge accounts, building insurance policy and schedule, service charge estimate for current year, copies of any other notices among a list of other documents that must be returned to the buyers solicitor.

FREE Template LPE1 Form

You can download this FREE template of an LPE1 form to see what it entails, however, your solicitor should be able to provide you with a copy of this.

Can Anyone Fill In An LPE1 Form?

I was only googling this myself a couple of months ago trying to save myself a buck or two. The answer is no.

As an LPE1 form is legally binding it should only be filled in by the landlord, the management company, the managing agent or the residents or tenants association.

Do not attempt to fill it in even if you know the answers as it could come back to bite you if you answer any of it incorrectly.

How Much Does An LPE1 Form Cost And Who Pays For It?

Unless you are the landlord or management company of your own leasehold property, then you will need to pay for the completion of an LPE1 form. The cost varies vastly, and greatly. I was quoted both £600 by the landlord and then £240 by the managing agent. But the average cost could be anywhere between £200-£800 to get it completed. This is just another thing you need to factor in when purchasing a leasehold property, there is many more caveats to selling and owning one than a freehold property (house).

An LPE1 form to gather the information is not mandatory, but it streamlines the process and makes it much easier for the landlord or managing agent to include all of the required information.

It ended up costing me £840 because the managing agent couldn’t complete two questions, and the purchasers needed everything to be complete for the sale to go through. It was a tough pill to swallow, but at this stage I just needed it to go through.

How Long Does An LPE1 Form Take To Complete?

When I looked at the two pieces of paper I had to pass across the managing agent my first thought was a) it’s literally 2 pages to complete b) for about 15 minutes work why is it going to cost me over £200?

It’s likely that it will be dealt with by someone on a legal team within the managing agent firm which means a few people can be involved in the completion of it. It also involves compiling year end accounts, budgets and building insurance invoices.

The average amount of time it takes for an LPE1 form to be completed is 4 weeks, but I got mine back within 10 days and they usually quote 2 weeks.

Make sure you give yourself enough time in the selling process to get this sorted, it’s definitely not one to leave to the last minute in case any issues arise from it.

What Happens If The Freeholder Is Refusing To Complete The LPE1?

An LPE1 is not mandatory, so the landlord is under no legal obligation to answer an LPE1 and might not be willing to do so.

However, often purchasers of a leasehold property will not proceed without this information. You could warn them (preferably a solicitor’s letter) if they don’t comply (give a specific time limit) that you’ll apply for a court injunction on the grounds of ‘unreasonably withholding consent’ and/or make a simultaneous claim for any financial losses / damages.

In Summary

Whilst it can raise an additional cost and stress which comes with selling a leasehold property, an LPE1 form is one that can’t be missed.

Ensure you give it plenty time to be completed and resolve any issues that might arise to avoid delays in the sale of your property.

Interesting. If its legally binding, how is this squared with the Note and Disclaimer on the bottom of the form? “only raise relevant enquiries” – ie if there’s stuff on there that’s wrong, only raise it if its ‘relevant’. Plus – they reply “to the best of their knowledge and abilitly”. I’ve got an LPE1 with loads wrong with it, and only half completed (42 out of 80 questions, and 32 of those are only ticked boxes!), I got charged £696 – which I paid up front so as not to compromise the sale. And now I’m currently “negotiating” to get that charge reduced, realistically, I’m going to end up in the Tribunal, but my freeholder is so awful that I’m prepared to go that route. En route, I’m copying my letter to my MP and LEASE to show that this is a bad form, a bad idea, and should be sent where the erstwhile House Seller’s information pack went, when it became apparent that wasn’t fit for purpose either.

and its quoted in a number of places as being ‘not mandatory’ – it is mandatory if you want a sale and the buyers solicitor insists on it.

The government apparently had legislation to cap the charge at £200 and less, £50, if it was a repeat request (ie a number of flats from the same block requiring the same legislation). However, I sucked up the £696 and sold the flat. I will never, ever, again touch anything leasehold.

Thanks so much for your comment, I wholeheartedly would NEVER buy leasehold again, it was an absolute nightmare to sell. Same with me that you cannot sell without an LPE1, I don’t know why people say you can. I ended up paying £600 to the freeholder as the managing agents couldn’t fill in a couple points, and they charged me £240. They’re unregulated and charge whatever they like, I really hope you win your case in the tribunal. If they have given false information it will be the freeholder that gets in trouble for it though, all answers should be accurate because it involves costs that the new owner will incur. Very interesting about the legislation cap, not heard of that previously. I also sucked the costs up because I would never have sold it else. We live and learn!

During the process of buying my flat neither the LPE1, completed by the managing agent (or the lease) referenced any restrictions on pets at all. Subsequently I was informed there were rules (the lease allows rules), affecting pets, that predated the completion of the LPE1. If this had been declared in the LPE1, I would not have bought the flat(leasehold with share of the freehold). I am now being told I will be in breach of my lease if I allow my dog in the communal gardens. I’ll probably have to sell my flat.

What can I do? Should I sue the managing agent or the freehold management company or both?

Hi Clive, apologies for the delay in coming back to you. So sorry to hear that this has happened, I would think the best route would be to go back to your solicitors that you used at the time to get their advice on the issue. The managing agent has lied on a legally binding form so you have a position with this, can I also recommend you put this question to the National Leasehold Campaign group on Facebook as I know someone will have answer for this; https://www.facebook.com/groups/786983251448976 Really hope you can get a resolution for this. Best wishes, Nicole.

Hi – can someone help? I purchased a leasehold flat (2 flats in building) and the freeholder stated on the LPE1 form that no Section 20 works are to be completed in the next 2 years. This was June 2022.

He is now saying I need to cover 50% of a roof replacement, which falls under Section 20 due to cost. He has had scaffolding up for a year so knew about this work before the sale.

Is this document binding on his part? I am ok to contribute something as a gesture but not the full amount.

Leasehold is a nightmare.

Hi Alan, so sorry to hear this has happened to you. I’m not a legal expert but I’d say they would be in breach of what was agreed on the LPE1 form, I’d firstly go back to your solicitors to raise this and see what they suggest as a first port of call.

I would also post this into the Leaseholders Campaign Facebook group as there will be somewhere that’s been through it before and will be able to advise; https://www.facebook.com/groups/786983251448976

I hope you can get this resolved, leasehold really is the worst!